When you receive your monthly salary and pay for rent, groceries, and various bills, you might still have some money left over. The question is: what do you do with it? Many people impulsively spend it on things they don’t really need, like extra gadgets, subscriptions, or occasional splurges.

Now, imagine if instead of spending that leftover money, you invested it in a Systematic Investment Plan (SIP) every month. Over time, thanks to the power of compounding, even small investments can grow significantly. Investing just $10 a month can accumulate into a substantial amount over 10–15 years.

This is where a SIP Calculator becomes a valuable tool. By planning regular small investments through a SIP, you can steadily save money and build wealth over time. LocalSavingGuide, a platform dedicated to providing readers with practical tips and strategies to save money, sees SIP investing not just as a way to grow your wealth but also as a smart way to avoid unnecessary spending.

(This Image was generated by https://localsavingguide.com/ using Nano Banana Pro)

To make things easier, we searched Google for the keyword “SIP Calculator” and compiled the top 6 SIP calculator tools here. This saves you the trouble of browsing through multiple sites and allows you to make informed investment decisions effortlessly in 2025.

📘 In this guide, you will get:

- What is a SIP Calculator?

- How to Use a SIP Calculator (Step-by-Step) | 2026 Update

- ──────────────────‧₊˚✧Top 6 SIP Calculator Tools You Should Try✧˚₊‧────────────────

- How to Choose the Right SIP Calculator for You

- Real-Life User Scenarios: How These SIP Calculators Solve Real Problems

- Tips & Tricks to Maximize Your SIP Returns

- FAQ: What Most People Ask About SIP Calculators

- Local Saving Guide’s Final Thoughts

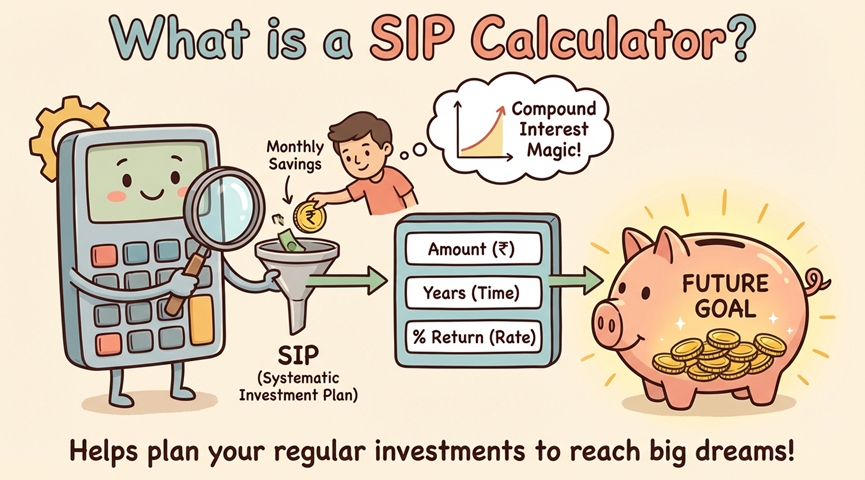

What is a SIP Calculator?

A SIP Calculator is an online financial tool designed to estimate the potential growth of your monthly investments over time. It takes into account:

- Monthly Contribution: How much money you can invest regularly.

- Expected Annual Return: Average growth rate of your investment.

- Investment Duration: Number of years you plan to stay invested.

The result is usually displayed in:

- Projected Corpus: Total amount you’ll have at the end of the investment period.

- Graphical Charts: Visual representation of corpus growth over time.

- Yearly Breakdowns: Principal vs. returns earned each year.

In short, a SIP Calculator transforms your savings into a roadmap for future wealth creation, helping you visualize how small steps today lead to financial security tomorrow.

(This Image was generated by https://localsavingguide.com/ using Nano Banana Pro)

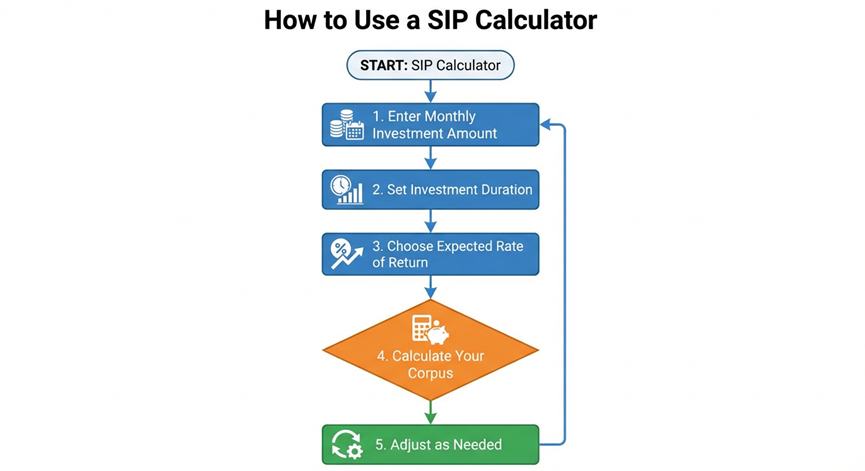

How to Use a SIP Calculator (Step-by-Step) | 2026 Update

Using a SIP Calculator is very simple. According to Local Saving Guide, the typical steps for using a SIP Calculator are as follows:

(This Image was generated by https://localsavingguide.com/ using Nano Banana Pro)

1️⃣ Enter Monthly Investment Amount

Decide how much you can comfortably invest each month without affecting your essential expenses.

2️⃣ Set Investment Duration

Select the number of years you plan to invest. Longer durations allow for higher compounding growth.

3️⃣ Choose Expected Rate of Return

Equity funds often provide 10–15% annual returns, while debt funds offer around 6–8%.

4️⃣ Calculate Your Corpus

Click the “Calculate” button, and the tool will display the estimated corpus, growth chart, and year-wise breakdown.

5️⃣ Adjust as Needed

Increase monthly contributions or extend the duration if your target corpus isn’t met.

💡 Pro Tip: Regularly revisiting your SIP Calculator results can help you tweak your investments and save money smarter.

──────────────────‧₊˚✧Top 6 SIP Calculator Tools You Should Try✧˚₊‧────────────────

At Local Saving Guide, we’ve compiled the Top 6 SIP Calculator tools to help you make smarter investment decisions. For each tool, we provide detailed features, practical usage examples, and clear recommendations to help you choose the right calculator for your financial goals.

(This Image was generated by https://localsavingguide.com/ using Nano Banana Pro)

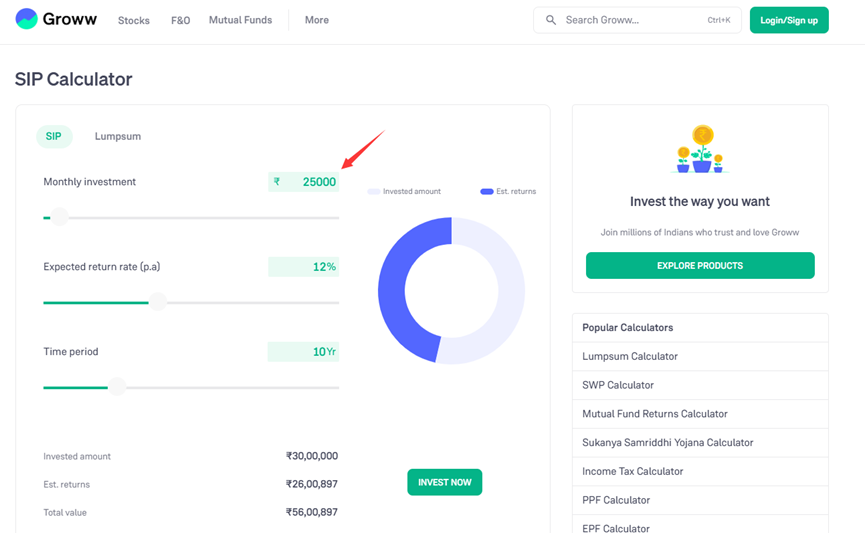

1. Groww SIP Calculator

🔎 Introduction:

Groww SIP Calculator is a user-friendly tool ideal for beginners who want to visualize how small monthly investments can grow over time. It provides interactive charts showing principal and returns, helping users understand the power of compounding and plan for goals such as buying a house or funding education.

🎯 Features:

- Interactive graphs and sliders

- Supports equity, debt, and hybrid funds

- Option to compare multiple SIP plans

✅ Usage Example:

Invest ₹5,000/month for 10 years at 12% annual return → projected corpus: ~₹12 lakh

🔥 Why Recommended:

Beginner-friendly, visually appealing, and fast. Ideal for goal-oriented planning.

🌐 Website: https://groww.in/calculators/sip-calculator

(Image Credit: https://groww.in/calculators/sip-calculator)

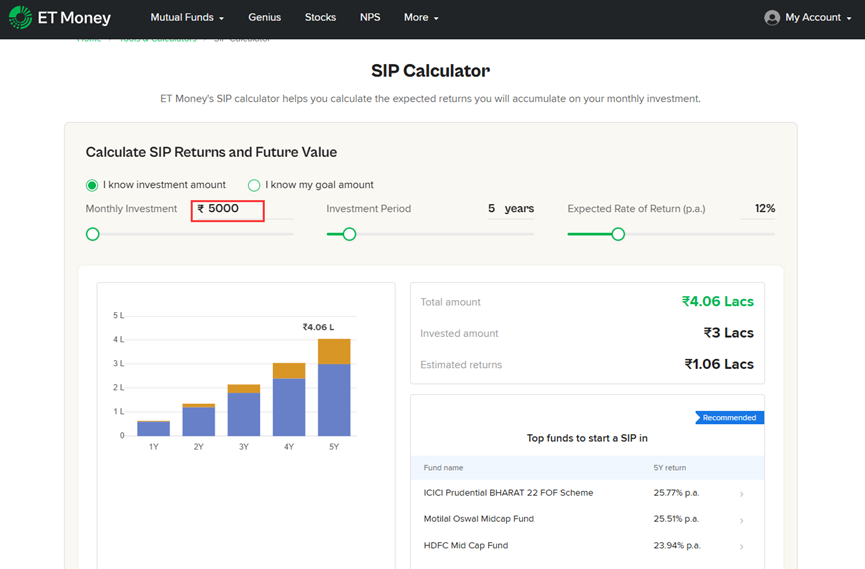

2. ET Money SIP Calculator

🔎 Introduction:

ET Money SIP Calculator focuses on goal-based investing, allowing users to set financial goals and see how much to invest monthly to reach them. It’s especially helpful for planning for major life events like a child’s education or a home purchase.

🎯 Features:

- Goal-based investment planning

- Inflation-adjusted projections

- Quick comparison between multiple SIPs

✅ Usage Example:

Target: ₹10 lakh for child’s education in 15 years → monthly SIP: ~₹5,000

🔥 Why Recommended:

Perfect for users with specific financial targets, offering clear projections and actionable insights.

🌐 Website: https://www.etmoney.com/tools-and-calculators/sip-calculator

(Image Credit: https://www.etmoney.com/tools-and-calculators/sip-calculator)

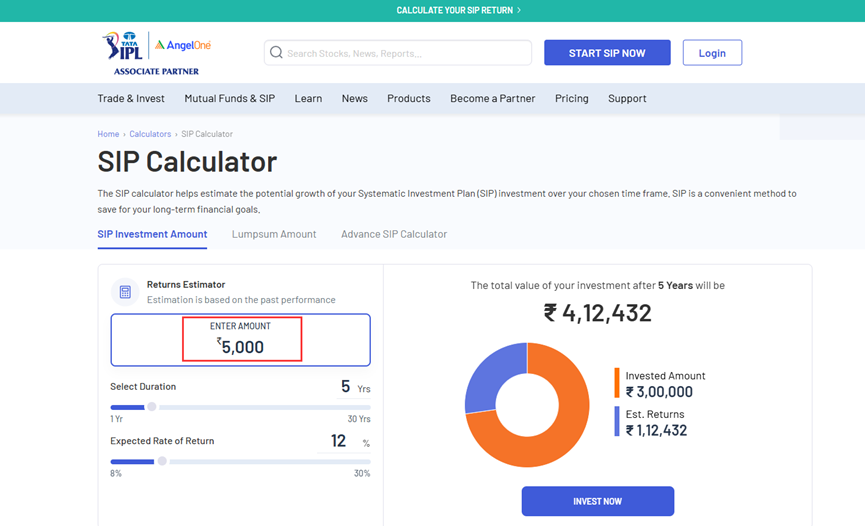

3. Zerodha Money SIP Estimator

🔎 Introduction:

Zerodha Money SIP Estimator is designed for advanced investors who need precise calculations. It offers year-wise breakdowns and allows users to simulate different contribution levels, durations, and expected returns to analyze multiple scenarios.

🎯 Features:

- Detailed year-wise corpus and returns

- Supports equity and debt funds

- Real-time simulation of different investment strategies

✅ Usage Example:

₹10,000/month for 20 years at 12% CAGR → shows principal vs. interest breakdown for each year

🔥 Why Recommended:

Highly precise and detailed, suitable for experienced investors seeking analytical insights.

🌐 Website: https://www.angelone.in/calculators/sip-calculator

(Image Credit: https://www.angelone.in/calculators/sip-calculator)

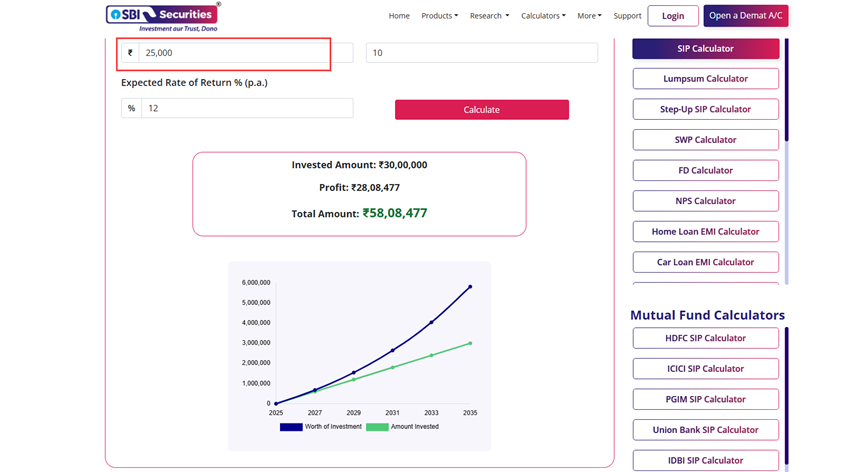

4. SIP Calculator – Systematic Investment Plan Calculator

🔎 Introduction:

SIP Calculator – Systematic Investment Plan Calculator from SBISecurities helps users plan their monthly investments and visualize long-term growth. It supports multiple fund types and provides clear charts, making it easier to see how small, consistent investments can grow over time.

🎯 Features:

• Calculate expected corpus for monthly SIP contributions

• Supports equity, debt, and hybrid funds

• Visual growth charts and year-wise projections

• Compare different SIP investment options

✅ Usage Example:

Invest ₹5,000/month for 10 years at 12% annual return → displays projected corpus and year-wise growth, highlighting the benefits of compounding

🔥 Why Recommended:

Ideal for both beginners and advanced investors who want a simple, reliable, and visual tool to plan their SIPs and track long-term wealth creation.

🌐 Website: https://www.sbisecurities.in/calculators/sip-calculator

(Image Credit: https://www.sbisecurities.in/calculators/sip-calculator)

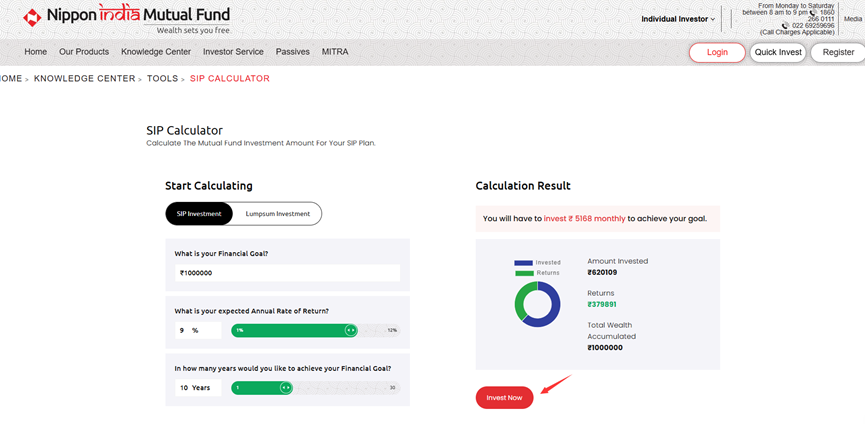

5. SIP Calculator – Nippon India Mutual Fund

🔎 Introduction:

The SIP Calculator from Nippon India Mutual Fund is designed for investors who want detailed, accurate, and long-term SIP projections backed by one of India’s most reputable asset management companies. This tool focuses on clarity and precision, helping users understand how their monthly contributions grow over time through the power of compounding. Whether your goal is retirement planning, wealth creation, or long-term savings, this SIP Calculator gives you a transparent view of your future corpus.

🎯 Features:

• Detailed projections of principal vs. returns

• Easy-to-use interface with clean numerical inputs

• Long-term investment forecasting with compounding

• Works for equity, hybrid, and debt fund estimates

• Provides year-by-year SIP growth breakdown

• Designed by a trusted financial institution with decades of expertise

✅ Usage Example:

If you invest ₹10,000 per month for 15 years at an estimated 12% return, the Nippon India SIP Calculator shows:

• Total invested amount

• Total corpus generated

• Interest earned through compounding

• A year-wise projection showing how your investment accelerates over time

This helps investors clearly visualize how staying consistent with SIPs can turn regular savings into long-term wealth.

🔥 Why Recommended:

This tool is ideal for investors who want accuracy, reliability, and simple projections backed by one of India’s largest and most trusted fund houses. Its straightforward structure makes it perfect for both beginners and experienced investors looking to save money and build a solid financial plan through SIPs.

🌐 Website: https://mf.nipponindiaim.com/knowledge-center/tools/sip-calculator

(Image Credit: https://mf.nipponindiaim.com/knowledge-center/tools/sip-calculator)

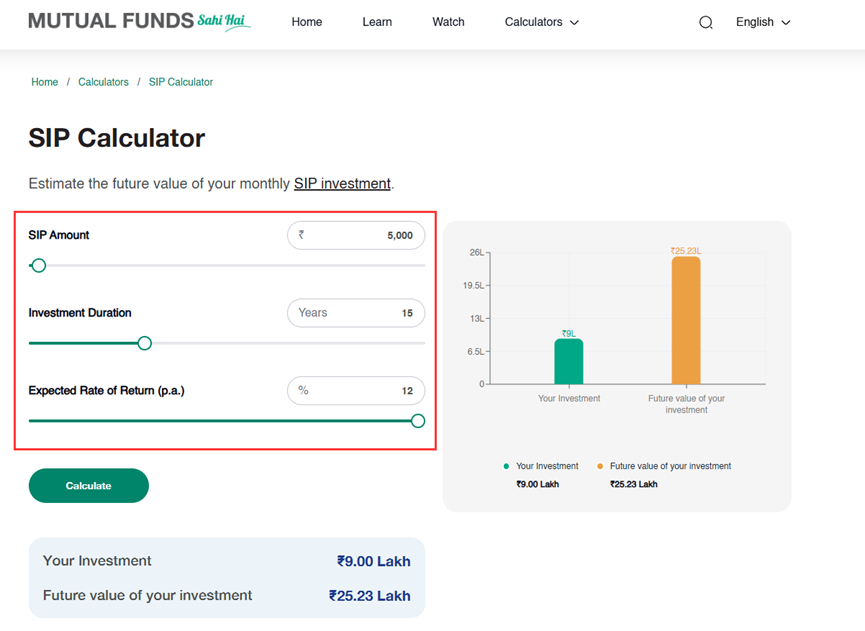

6. SIP Calculator – Calculate Returns on SIP Investments

🔎 Introduction:

The SIP Calculator from Mutual Funds Sahi Hai provides a clean and reliable way for investors to estimate long-term SIP returns. It helps beginners and experienced investors understand how monthly contributions grow through compounding, making it easier to plan financial goals and save money effectively.

🎯 Features:

• User-friendly and clutter-free interface

• Detailed corpus projection based on monthly SIP, duration, and expected return

• Clear breakdown of investment amount vs. estimated returns

• Quick calculation ideal for fast comparisons

✅ Usage Example:

Enter ₹5,000/month, 12% expected return, 10-year duration → instantly shows projected corpus, investment growth, and total wealth created through compounding.

🔥 Why Recommended:

Perfect for users who want a simple, reliable, and accurate SIP Calculator without distractions. Its clean interface makes it ideal for quick checks or planning long-term financial goals.

🌐 Website: https://www.mutualfundssahihai.com/en/calculators/sip-calculator/

(Image Credit: https://www.mutualfundssahihai.com/en/calculators/sip-calculator/)

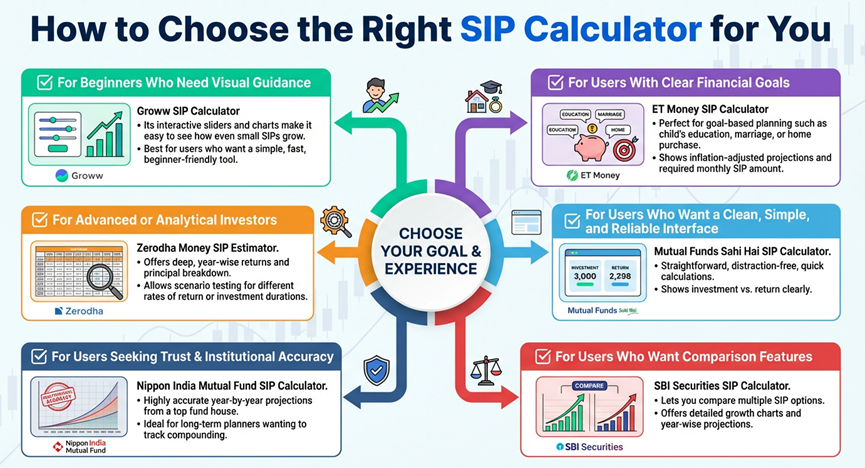

How to Choose the Right SIP Calculator for You

Choosing a SIP Calculator depends on your goals and experience:

✅ For Beginners Who Need Visual Guidance

- Its interactive sliders and charts make it easy to see how even small SIPs grow.

- Best for users who want a simple, fast, beginner-friendly tool.

✅ For Users With Clear Financial Goals

ET Money SIP Calculator

- Perfect for goal-based planning such as child’s education, marriage, or home purchase.

- Shows inflation-adjusted projections and required monthly SIP amount.

✅ For Advanced or Analytical Investors

Zerodha Money SIP Estimator

- Offers deep, year-wise returns and principal breakdown.

- Allows scenario testing for different rates of return or investment durations.

✅ For Users Who Want a Clean, Simple, and Reliable Interface

Mutual Funds Sahi Hai SIP Calculator

- Straightforward, distraction-free, quick calculations.

- Shows investment vs. return clearly.

✅ For Users Seeking Trust & Institutional Accuracy

Nippon India Mutual Fund SIP Calculator

- Highly accurate year-by-year projections from a top fund house.

- Ideal for long-term planners wanting to track compounding.

✅ For Users Who Want Comparison Features

SBI Securities SIP Calculator

- Lets you compare multiple SIP options.

- Offers detailed growth charts and year-wise projections.

(This Image was generated by https://localsavingguide.com/ using Nano Banana Pro)

Real-Life User Scenarios: How These SIP Calculators Solve Real Problems

LocalSavingGuide has curated a few real-life cases to show how SIP Calculators can help you achieve your savings goals and plan your finances effectively. These examples demonstrate how you can manage monthly investments wisely, effortlessly save money, and build wealth over time.

📌 Scenario 1: A Beginner Trying to Save for a Future House

Tool Used: Groww SIP Calculator

Riya, a 26-year-old professional, invests ₹5,000 monthly for 10 years.

Groww’s visual chart instantly shows she could build a corpus close to ₹12 lakh at 12% CAGR.

The visual breakup helps her realize how compounding accelerates in later years.

📌 Scenario 2: A Parent Planning for Child’s Education

Tool Used: ET Money SIP Calculator

Rahul needs ₹10 lakh in 15 years for his child’s college fees.

ET Money recommends ~₹5,000 monthly SIP with inflation-adjusted projections.

This helps him set a precise, actionable financial plan.

📌 Scenario 3: An Experienced Investor Testing Multiple Strategies

Tool Used: Zerodha Money SIP Estimator

Amit tests:

- ₹8,000/month at 12%

- ₹10,000/month at 10%

- ₹12,000/month at 12%

Zerodha provides detailed year-wise breakdowns and return curves, enabling him to choose the most rewarding long-term plan.

📌 Scenario 4: A Conservative Saver Comparing SIP Options

Tool Used: SBI Securities SIP Calculator

Neha compares hybrid vs. debt fund SIP projections to balance low risk and stable growth.

The comparison charts help her choose a safer option.

📌 Scenario 5: A Long-Term Investor Planning Retirement

Tool Used: Nippon India Mutual Fund SIP Calculator

Mahesh invests ₹10,000 monthly for 15 years.

The tool shows:

- Total investment

- Total returns

- Year-wise compounding

Providing clarity and trust backed by a major mutual fund house.

📌 Scenario 6: A User Who Wants a Quick Estimate Without Complexity

Tool Used: Mutual Funds Sahi Hai SIP Calculator

Sneha checks how ₹5,000/month for 10 years at 12% CAGR grows.

She gets instant results with no distractions—perfect for budgeting and quick planning.

(This Image was generated by https://localsavingguide.com/ using Nano Banana Pro)

Tips & Tricks to Maximize Your SIP Returns

Want to get the most out of your SIP investments? In this section, Local Saving Guide shares practical tips to help you optimize your investment strategy, boost returns, and maintain effective saving habits.

💡 1. Use Multiple SIP Calculators for Cross-Verification

Different platforms provide slightly different projections.

Comparing Groww, ET Money, and Zerodha results helps you get a more realistic estimate.

💡 2. Always Check Year-Wise Breakdowns

Tools like Nippon India MF and Zerodha show year-by-year compounding.

This helps you see how returns accelerate—especially in years 8–15.

💡 3. Adjust for Inflation

ET Money includes inflation-adjusted results.

This is essential for long-term goals like children’s education or retirement.

💡 4. Compare SIP Plans Before Investing

Tools like SBI Securities allow side-by-side comparisons.

Use them to avoid blindly choosing a mutual fund.

💡 5. Don’t Use SIP Calculators Only Once

Update your numbers when:

- Your salary increases

- Your goals change

- Market expectations shift

This keeps your financial plan accurate.

💡 6. Use Clean Tools for Quick Planning

Mutual Funds Sahi Hai is ideal when you want fast, simple answers for monthly budgeting.

💡 7. Trust Tools Backed by Institutions

Nippon India MF and SBI Securities SIP Calculators offer reliable projections due to institutional expertise.

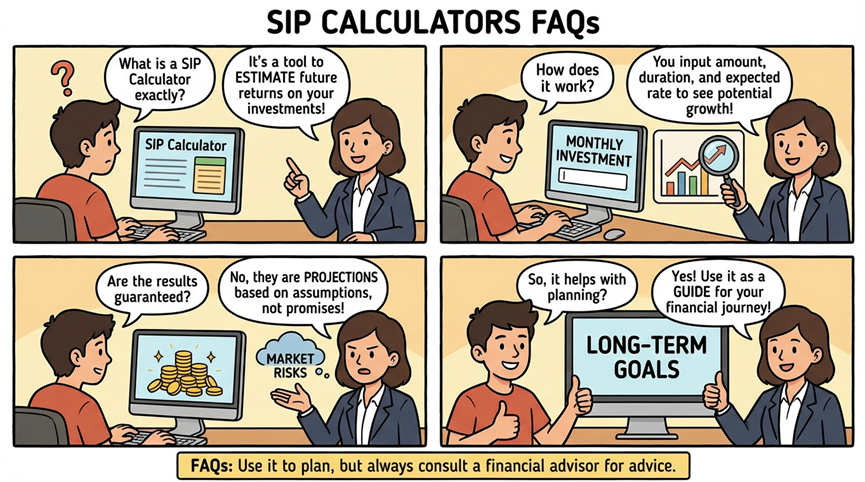

FAQ: What Most People Ask About SIP Calculators

When using a SIP Calculator, you may have some common questions. In this section, Local Saving Guide compiles the most frequently asked queries and provides clear, easy-to-understand answers to help you plan your investments and save money more effectively.

(This Image was generated by https://localsavingguide.com/ using Nano Banana Pro)

❓ 1. Are SIP Calculators accurate?

SIP Calculators—like those from Groww, ET Money, and Nippon India—are highly reliable for estimation.

However, they use assumed return rates (e.g., 10–12% CAGR), so actual results may vary depending on market conditions.

❓ 2. Which SIP Calculator should beginners use?

Beginners should start with Groww SIP Calculator (easy visuals, sliders) or Mutual Funds Sahi Hai SIP Calculator (simple & fast). Both make projections easy to understand without complex financial terms.

❓ 3. Which SIP Calculator is best for long-term planning like retirement?

For long-term planning, the best options are Nippon India Mutual Fund SIP Calculator (detailed year-wise projections) and ET Money SIP Calculator (inflation-adjusted planning), they’re ideal for goals beyond 10–20 years.

❓ 4. Can SIP Calculators show inflation-adjusted values?

Yes, but only some tools do—ET Money is one of the best for inflation-adjusted planning.

This helps you calculate how much money you REALLY need in the future.

❓ 5. Do SIP Calculators help with fund comparison?

Yes. SBI Securities SIP Calculator and ET Money both allow users to compare multiple SIPs side-by-side and pick the best.

❓ 6. How often should I use a SIP Calculator?

At least: once per year, or whenever your income or financial goals change.

Regular updates ensure your SIP stays aligned with your goals.

❓ 7. Which SIP Calculator offers the most detailed breakdown?

For deep analytics and year-wise breakdowns, choose Zerodha Money SIP Estimator or Nippon India Mutual Fund SIP Calculator, they are ideal for advanced investors.

❓ 8. Can SIP Calculators help me save money?

Absolutely. By showing how your small monthly SIP grows over time, calculators like Groww and Mutual Funds Sahi Hai help you:

- avoid unnecessary expenses

- plan monthly budgets

- stay disciplined with long-term saving

❓ 9. Is it free to use SIP Calculators?

Yes. All six SIP Calculators—Groww, ET Money, Zerodha, SBI Securities, Nippon India, and Mutual Funds Sahi Hai—are 100% free.

❓ 10. Which SIP Calculator should I use if I want quick results?

Use Mutual Funds Sahi Hai SIP Calculator, it loads instantly, gives simple results, and doesn’t require registration.

Local Saving Guide’s Final Thoughts

A SIP Calculator is not just a tool—it’s your roadmap to disciplined investing. By investing small amounts consistently, you can save money, plan for future goals, and build long-term wealth.

The top 6 SIP Calculator tools recommended by LocalSavingGuide cater to beginners, advanced investors, and those seeking tax optimization. Start early, use these tools regularly, and watch your financial goals turn into reality.

Remember, every small investment today can grow into substantial wealth tomorrow. Start using a SIP Calculator and discover the smartest ways to save money in 2025.